Beating Cross-Border Payment Issues With A Business Account

With the global economy, businesses now operate beyond borders, interacting with global clients, suppliers, and partners. Managing international transactions comes with numerous issues, ranging from high fees and delayed processing speeds to foreign exchange risks and regulatory hurdles. Such issues can disrupt business, affect profitability, and introduce financial inefficiencies.

To solve these problems, companies need to embrace an organized method of international payments. One of the best possible solutions is to open a specific business account that can make cross-border payments easily. Let us discuss the primary issues of making and receiving international payments and how business account opening can avoid them.

Challenges of Sending and Receiving International Payments

1. High Transaction Costs and Hidden Fees

Global payments are usually accompanied by large fees, such as wire transfer fees, intermediary bank fees, and currency exchange fees. Traditionally, banks and payment processors can include hidden fees that raise transaction costs considerably, diminishing the overall profit margins of firms participating in global trade.

2. Foreign Exchange (FX) Rate Volatility

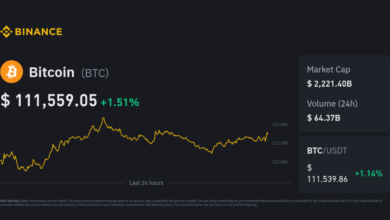

Forex rate fluctuations may affect the ultimate amount received or paid by businesses. In the absence of real-time FX rates and transparent pricing, businesses may suffer unforeseen losses from unfavorable exchange rates.

3. Delays in Transaction Processing

International payments take up to a few days to settle because intermediaries pass through the transaction. The delay can lead to cash flow problems, disrupt supplier relationships, and affect business operations that need timely payment.

4. Compliance and Documentation

International transactions are governed by several regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations. Companies have to go through intricate compliance procedures, which may result in delays and further administrative work.

5. Inadequate Transparency in Payment Tracking

Most companies struggle to monitor the status of their cross-border payments. Inadequate transaction timelines and no real-time visibility can lead to inefficiencies, vendor miscommunication, and financial reconciliation issues.

6. Limited Access to Multi-Currency Accounts

Multiple currencies need to be managed by companies with international operations. Conventional banks, however, ask companies to maintain different accounts for different currencies, resulting in inefficiencies and increased maintenance expenses.

How a Business Account Solves These Issues

An organized business account specifically designed for global operations can greatly simplify such payment issues. Here’s how:

1. Reduced Transaction Charges and Transparent Fees

A specialized business account meant for international operations provides affordable global payment solutions with transparent fee structures. Firms can enjoy reduced transfer costs, competitive foreign exchange rates, and transparent fees, allowing for improved financial control.

2. Access to Competitive Foreign Exchange Rates

Business accounts with real-time FX rate updates allow companies to make payments at the best available conversion rates. Certain accounts give businesses up to three times more affordable FX rates than usual banks, allowing them to maximize international payments and reduce currency fluctuation risks.

3. Quicker Payment Processing

Unlike conventional banking channels, new business accounts use fintech developments to facilitate fast cross-border transactions. Companies can send and receive payments in several currencies within hours rather than days, improving cash flow and relationships with suppliers.

4. Simplified Compliance and Documentation

Business accounts have integrated compliance tools, cutting down on administrative work in compliance with regulatory standards. Automated KYC and AML checks allow companies to speed up verification and secure payments without delays.

5. Real-Time Payment Tracking

An account that is integrated with tracking features enables businesses to keep track of their transactions in real time. Transparency lowers uncertainties, enhances vendor communication, and helps improve overall financial planning.

6. Multi-Currency Account Management

Rather than having separate accounts in several jurisdictions, companies can group their foreign transactions into one multi-currency account. This streamlines financial functions, eliminates the cost of maintaining multiple accounts, and enables companies to keep and transfer money in several currencies at ease.

Other Features to Support International Transactions:

In addition to addressing fundamental issues, contemporary business accounts come with other features specifically designed for international firms:

- Virtual Corporate Cards: Companies can provide virtual cards for international payments, lessening reliance on bank transfers and giving improved control over spending.

- Integration with Accounting Software: Integration with the latest software tools, such as Xero, QuickBooks, and SAP, assists in automating bookkeeping, minimizing errors, and saving precious time.

- Expense Management Solutions: Companies can manage international transactions effectively, categorize expenses, and create real-time financial reports.

- Cross-Border SWIFT Transfers: Secure, low-cost SWIFT payments enable businesses to transact globally with ease.

Conclusion:

Companies seeking to maximize their cross-border payments need to consider business accounts that provide efficient, affordable, and secure global transaction solutions. An efficient way of making cross-border payments enhances financial stability and strengthens relationships with global clients and partners.